Keep in mind that you’ll only need to register your business if you choose a structure that requires incorporation. When you’re deciding whether to register your online business, it’s a good idea to think about where you’ll do business.

Appointing the officers and directors, issuing shares to the shareholders and taking such other actions as necessary. This will affect your budget, your need for office space and your knowledge of US federal, state and local employment laws. This is a functional model you can use to create your own formulas and project your potential business growth. It’s recommended that any corporation should have an insurance policy. I wasn’t familiar with this until I read a recent article by Josh Pigford from Baremetrics, but he absolutely convinced me of the need. Additionally, if you use vehicles in your business, almost every state—including Florida, New York, and Texas—requires you to have auto insurance, usually commercial auto insurance. You can complete and mail an Application for Registration of Fictitious Name to register your FBN.

This flexibility lets an LLC’s members (another term for owners) find the taxation structure that works best for their finances, all while staying completely legal. These potential LLC tax savings and personal liability protection are just a few of the numerous benefits of an LLC. A corporation is a type of business entity that offers limited liability for owners, the shareholders.

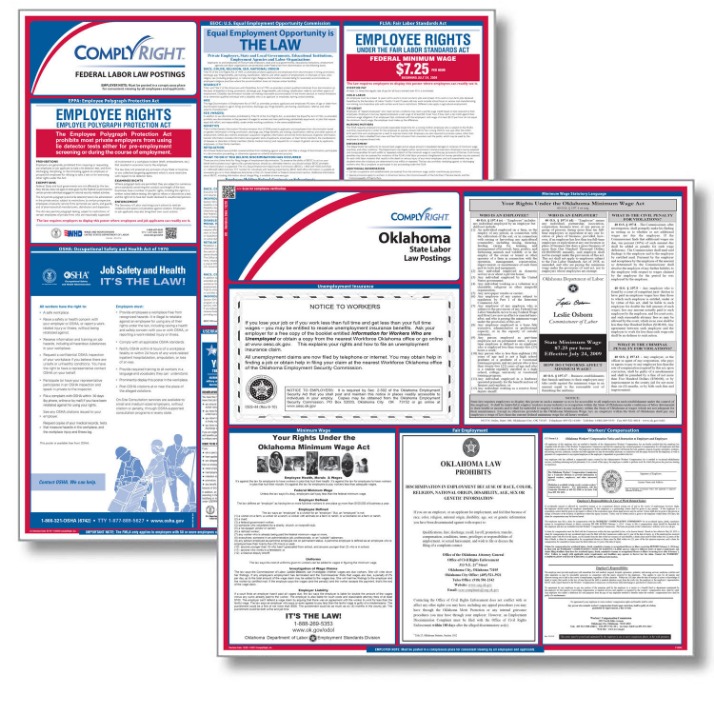

Acquire business licenses and permits

Any business owner who seeks to limit their personal liability for business debts and lawsuits should consider forming an LLC. A foreign LLC is created in one state but authorized to do business in another state. It requires registration of your existing LLC with the state in which you want to operate. Foreign LLCs are still subject to naming and registered agent requirements, and often face a higher registration fee than domestic LLCs. Although forming a Foreign LLC is largely the same process as forming a regular LLC, you may need to submit additional documents to the Secretary of State (e.g., a Certificate of Good Standing). It saves existing business owners the trouble of creating an LLC from scratch, however. Read more about USA company formation here. Sole proprietorships, partnerships, and S corporations may be the best type of business entity for tax purposes.

What is an LLC? Limited liability company definition

Platforms like Paypal or Shopify Payments will also need you to provide an SSN or ITIN before you apply for an account with them. If your US Company needs to receive payments via Paypal or Shopify Payments, it is advisable to get an ITIN.

It is an important document that investors and sponsors often need. Business plans explain business costs, especially startup costs, to start the business. Besides, a detailed business plan helps you to set business goals, look at the dynamic market trends, and it allows you to move further with a new strategy. These are basic questions to ask yourself before you decide on business ideas. Once you know what you want to do or what you are good at, you shall get your business idea.

Although this is changing slowly, US customers do not typically trust companies that require overseas payment. You are not required to incorporate in the state where your business operates; you have the freedom to incorporate in any state you prefer. When creating a new company, the proposed name of the company is only checked in that state. Therefore, a company name is only protected in the state where it is incorporated and in any state in which it is registered to do business. Once you’ve decided what type of company you’d like to form and which state you will be forming the company, there are only a few basic requirements we need to form your company for you.